Market cap of all cryptocurrencies

Cryptocurrencies are likely to become more relevant in 2025 as fintechs, emboldened by the Trump administration’s support, push them as a viable means of payment $10 minimum deposit casino usa. Stablecoins, which are a less volatile alternative to digital assets like bitcoin, will be the biggest beneficiaries of that new momentum, according to analysts and consultants who follow the industry.

Mushrooming consumer use of digital payments will keep a focus on real-time payments, even if it’s partly because the Fed has had some difficulty attracting banks to FedNow, its new instant payments system.

“If we leverage all of the data that we know about a customer, and what we think is going to be the best outcome for that customer — what’s the right buy now, pay later options for them — we can give them a recommendation based on that,” Husaini said in an interview.

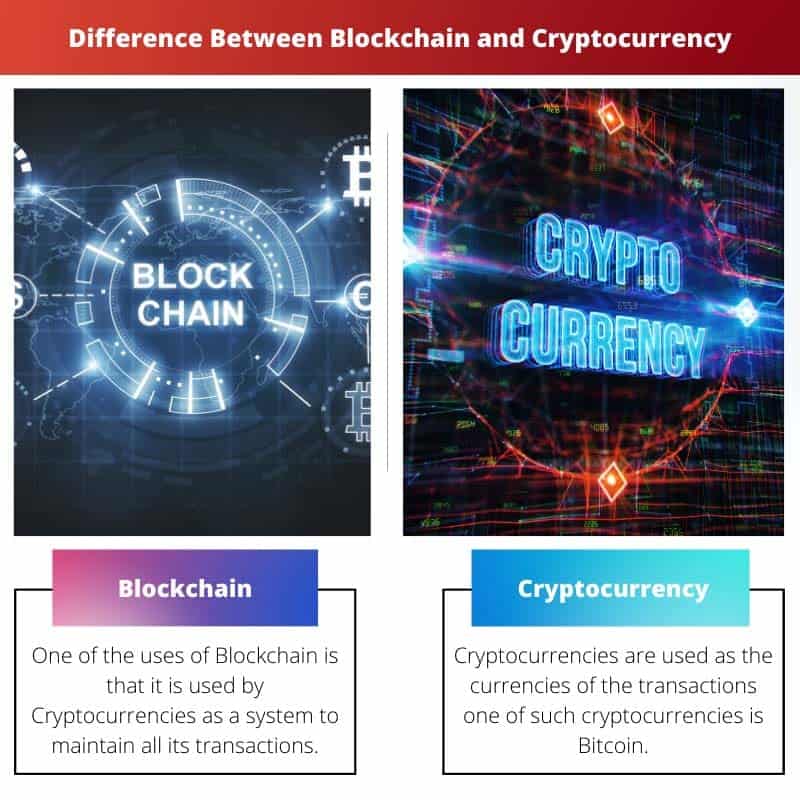

Are all cryptocurrencies based on blockchain

Because of the decentralized nature of the Bitcoin blockchain, all transactions can be transparently viewed by downloading and inspecting them or by using blockchain explorers that allow anyone to see transactions occurring live. Each node has its own copy of the chain that gets updated as fresh blocks are confirmed and added. This means that if you wanted to, you could track a bitcoin wherever it goes.

Cryptocurrencies pioneered in blockchain technology. And while blockchain has many advantages over traditional, centralized banking systems, some believe that there are drawbacks to certain aspects of blockchain technology, including scalability problems, slow block creation times, mining fees and double-spending attacks.

Not all blockchains are 100% impenetrable. They are distributed ledgers that use code to create the security level they have become known for. If there are vulnerabilities in the coding, they can be exploited.

How do I purchase Bitcoins? This will depend on your chosen exchange, but you will generally need to provide some form of ID and proof of residence as well as bank account information. Some exchanges may make you verify your identity before purchasing while others will require only identification.

A new and smaller chain might be susceptible to this kind of attack, but the attacker would need at least half of the computational power of the network (a 51% attack). On the Bitcoin and other larger blockchains, this is nearly impossible. By the time the hacker takes any action, the network is likely to have moved past the blocks they were trying to alter. This is because the rate at which these networks hash is exceptionally rapid—the Bitcoin network hashed at a rate of around 640 exahashes per second (18 zeros) as of September 2024.

All the cryptocurrencies

Almost. We have a process that we use to verify assets. Once verified, we create a coin description page like this. The world of crypto now contains many coins and tokens that we feel unable to verify. In those situations, our Dexscan product lists them automatically by taking on-chain data for newly created smart contracts. We do not cover every chain, but at the time of writing we track the top 70 crypto chains, which means that we list more than 97% of all tokens.

These crypto coins have their own blockchains which use proof of work mining or proof of stake in some form. They are listed with the largest coin by market capitalization first and then in descending order. To reorder the list, just click on one of the column headers, for example, 7d, and the list will be reordered to show the highest or lowest coins first.

A coin refers to cryptocurrencies and tokens, digital assets created and managed on blockchain networks. A cryptocurrency, also known as ‘crypto,’ is a digital currency that uses cryptography for security and operates on a decentralized blockchain network. Cryptocurrencies are native coins of their respective blockchains used to pay transaction fees and facilitate transactions within that network. Examples of cryptocurrencies include Bitcoin (BTC) and Ethereum (ETH).

On the other hand, tokens are digital assets that are not native to a particular blockchain but are created on existing blockchain platforms, typically through tokenization. Tokens can represent various types of assets, such as utility tokens, security tokens, or non-fungible tokens (NFTs). They can be easily created using templates, where developers specify parameters like initial supply, number of decimals, and other metadata. Most tokens are created on established blockchain networks like Ethereum, using standards such as ERC-20 for fungible tokens and ERC-721 for non-fungible tokens.

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.